Denial to Acceptance

Hello Friends,

We received encouraging response from the readers of our previous letter and some interesting suggestions, which we decided to include in the coming letters.

One of which has been naming it as “Apaarr Notes” and we are thankfully accepting that from today’s issue. Another important suggestion has been to keep it event-based or fortnightly. So, we would like to accept this suggestion and have it event-driven and if no major event then it can come to you fortnightly basis on weekends for a relaxed glance through.

Reiterating that our focus will be on the matters which can help individuals, corporations, investors and traders.

In today’s notes, let us present how things have shaped in the last few weeks. And then share our thoughts on the possible way forward in the coming weeks.

US Markets responded to the technical resistance and fell massive 1800 points on a single day but gradually came back after the US Fed confirmed its plans to directly buy US corporate debts. This provided a great boost to the market and it regained all the lost points in the next week. This strengthens the FOMO emotions (Fear of missing out), which we highlighted in the last letter, and will lead to new buy orders from such individuals while it trickles down the hill. And precisely, that’s what we need to avoid doing.

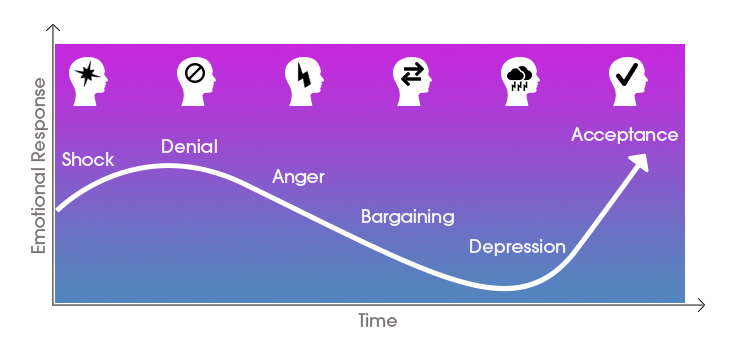

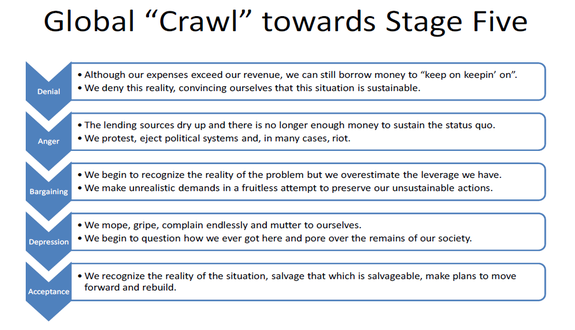

With the act of buying corporate bonds is the news of the past, we need to look forward to what’s next in line. Such massive debt push by the US Fed reminds me of the work of world-renowned Dr Elisabeth Kübler-Ross (July 8, 1926 – August 24, 2004), who introduced the theory of stages of grief through Kubler-Ross Model.

It is very important to look at Kubler-Ross Model in today’s context of how world markets are functioning.

In the last two weeks, geopolitical tensions have risen at selective parts of the world, unlock down activities have started showing numbers, a new brigade of Robin hood investors emerged as a surprise to the market, job market again showing signs of fatigue and historical physical delivery of gold on the COMEX exchange.

In light of space concern, we will shed thoughts on a few important ones. The border tension is one of those important for us. Distinctly this time, the tension across the border is emerging at many locations and graduating at a rapid pace. India-China, Greece-Turkey, North Korea-South Korea, China-Hong Kong and few more regional issues in Arab and Europe. Formation of groups is shaping up as Russia, Italy and Israel backing Greece and this side Nepal, Bangladesh, Sri Lanka and Pakistan backing China, whereas Tibet backing India. Will these escalate into a major military action or will it subside after some show of strength?

Better to look at the hedging options for next 45 days till these things get clear. Gold can be one way of building adjusted hedge in the portfolio or selective index options can be used.

Inflation indicative messages always augur well for gold as an investment, such as the article on CNN is informative to understand what exactly is happening in the oil industry and why JP Morgan believes that Oil can spike to US $ 190 in the next couple of years. The debt shock will throw weak and highly leveraged companies out of business, the excess capacity will be trimmed and that will lead to supply-side pressure in many asset-heavy industries. So we must be preparing for a low demand but high inflation era in the coming years.

This calls for an action to redesign asset allocation which can benefit from these macro shifts which are slow but unavoidable. Sooner we move to acceptance and take actions, we stand to gain from the chaos.

This point about the time period brings us to the famous Kubler-Ross Model – Five stages of economic grief - Denial to Acceptance

The success factor is how quickly one can move from the denial stage to the acceptance stage. That’s the reason time is drawn on X-axis of the chart.

This is equally applicable to individuals and companies. When we accept the situation, then only we can get to the action needed for the next rebuild phase.

Market Commentary

With these inputs, we believe we will see very interesting days ahead. On global markets, we may see slow grinding down the hill. Some geopolitical action may give fuel to the volatility.

Equities:

Globally equities may grind lower and this time with lesser hopes of regaining lost grounds but infrequent spikes would be there. The Indian equity market has rallied 15% in the last 30 days so the coming F&O expiry will be interesting to watch out. Post that, a clear direction may emerge, which moreover looks like a downward spiral. The reasons may be border issues or rebalancing of trade positions with what happens in the US markets.

Currencies:

US Dollar and Euro might remain weaker and thus we maintain our positive bias towards GBP and Yen. USDINR pair lacks clarity as border issues can play spoil for the pair.

Crude Oil

Crude oil may give a sudden surprise spike and that’s where we would take short term exit from the last batch of oil ETFs XOP, XLE and UCO. But Oil and other industrial commodities will remain our favourite to buy on dips as we believe supply-side shock is unavoidable.

Metals: Gold Silver Copper

Gold has crossed important weekly the resistance of $1745 and is set to move higher to 1840 range. Massive physical delivery at COMEX will induce further fuel at higher levels.

Our favourite will be the ETFs DSP World Gold Fund, GDX and GDXJ. We would add to gold allocations on Monday and Tuesday as the price swing may be around after the breach of resistance.

The picture below speaks about the big swing expectations in the Silver.

So selective purchases have to be planned on Silver in coming week and our favorites will be silver mining companies.

Copper and other industrial metals are in buy on dip zone and at current prices it is in no trade zone.

Advisory

These are information, views of best of minds and my humble opinion, take the trade and investment decisions based on your risk profile, objectives and asset allocation. There are times we need to sit on cash and wait for the market to correct and there are times when we have to stay invested and allow the market to move up. In short, inaction in the market is the most rewarding act, once you are set on a clear plan. So fill up buying orders on asset class where there is a need to allocate funds and reduce priced up assets to keep cash for better times.

This is a complimentary note and can be circulated with friends and family members. Advisory is always one to one and this note has no relation to the advisory. We may share views but this piece is not to be considered as advisory. A note may have mention of various authors/videos/views, which are sourced from the internet and respective owners own them and have made it available free for all, it is reproduced here for awareness.

You can drop a mail to [email protected] for blocking time for your queries on taking things forward and working together on any of our core services.